Business Insurance in and around Randallstown

Calling all small business owners of Randallstown!

Helping insure businesses can be the neighborly thing to do

- Randallstown

- Sykesville

- Eldersburg

- Westminster

- Carroll County

- Howard County

- Frederick County

- Baltimore County

- Washington County

- Allegany County

- Garrett County

- Charles County

- Owings Mills

- Woodbine

- Finksburg

- Reisterstown

- Catonsville

- Hampstead

- Millford Mill

- Mount Airy

- Frederick

- Ellicott City

- Columbia

- Woodlawn

This Coverage Is Worth It.

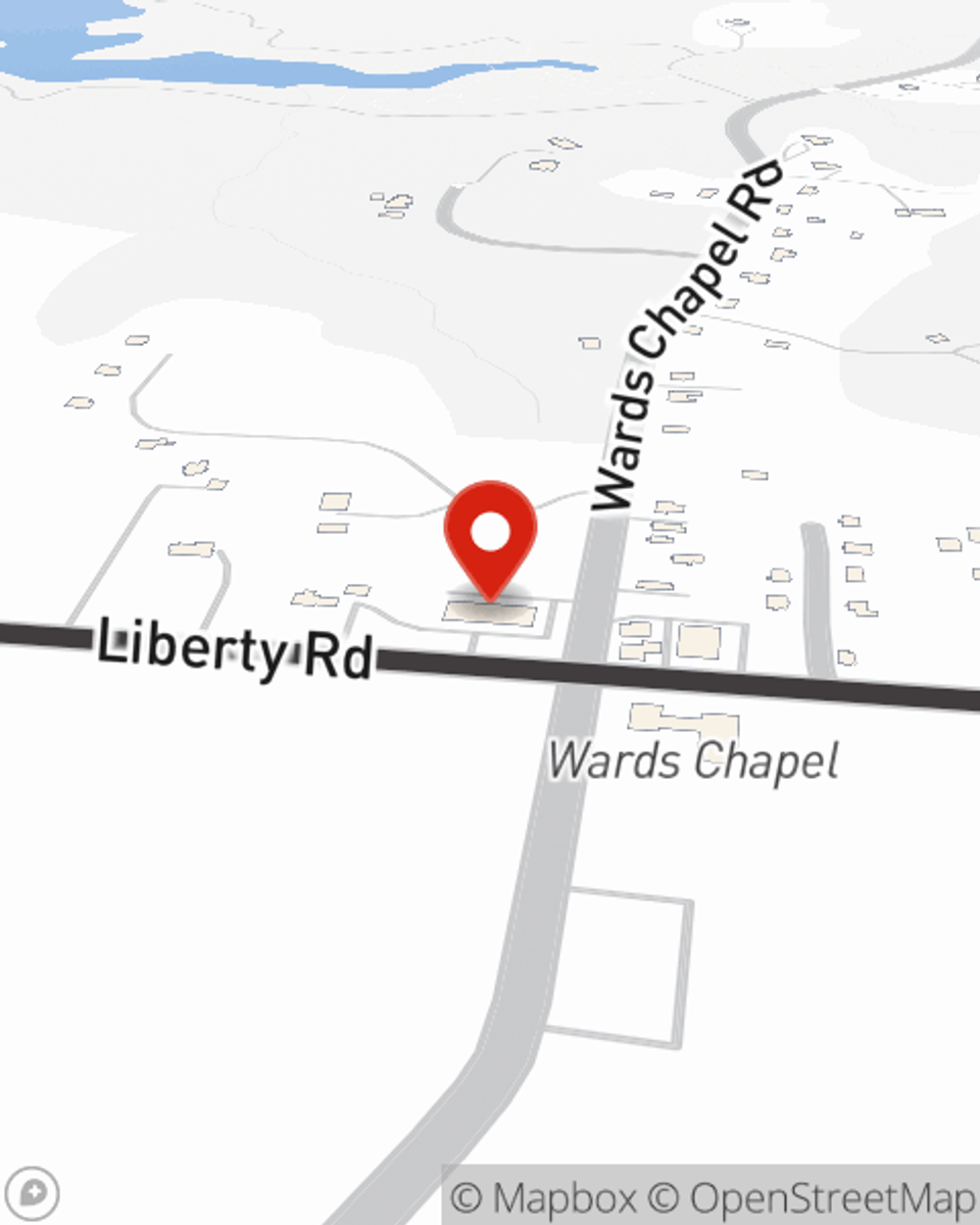

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Adam Fitzpatrick help you learn about quality business insurance.

Calling all small business owners of Randallstown!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

For your small business, whether it's a travel agency, a window treatment store, a beauty salon, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like computers, accounts receivable, and equipment breakdown.

It's time to visit State Farm agent Adam Fitzpatrick. You'll quickly perceive why State Farm is one of the leaders in small business insurance.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Adam Fitzpatrick

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.